Momentum Trading: Provides you with simple stock and option strategies that are designed to make you a successful trader.

Monday, December 26, 2011

Leveraged ETFs (27 Dec 11): ERX

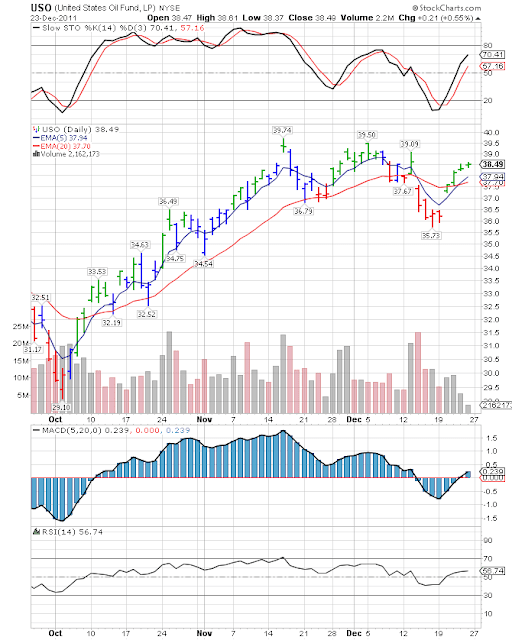

Traditional ETFs (27 Dec 11): USO

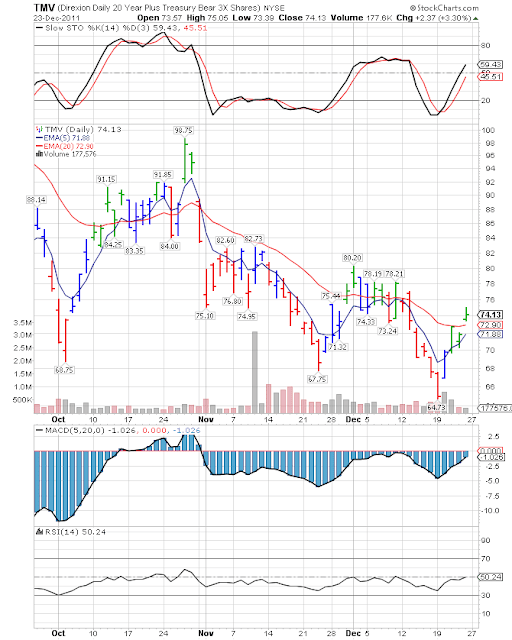

Fixed Income ETFs (27 Dec 11): TMV

Bull Call Spread (27 Dec 11): SSO

|

| Look for a bullish market where you anticipate a modest increase in the price of the stock above the price of the short Call option. |

SSO $47.00

Buy to Open (1) Jan 12 44 C @ $3.85Sell to Open (1) Jan 12 49 C @ $0.85

Net Debit: $3.00 ($300.00)

Breakeven: $47.00

Max. Profit: $200.00

Pct Return: 66.7% (25 days)

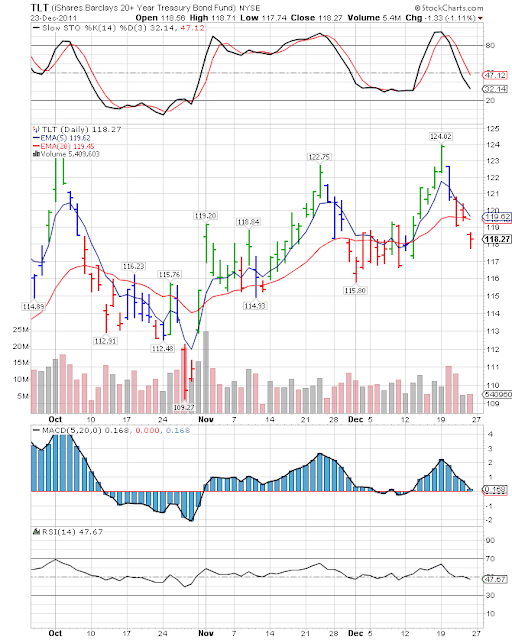

Bear Put Spread (27 Dec 11): TLT

|

| Look for a bearish market where you anticipate a modest decrease in the price of the stock below the strike price of the short Put option. |

TLT $118.27

Buy to Open (1) Jan 12 121 P @ $4.25Sell to Open (1) Jan 12 116 P @ $1.45

Net Debit: $2.80 ($280.00)

Breakeven: $118.20

Max. Profit: $220.00

Pct Return: 78.6% (25 days)

Friday, December 23, 2011

Momentum ETFs (23 Dec 11): TNA

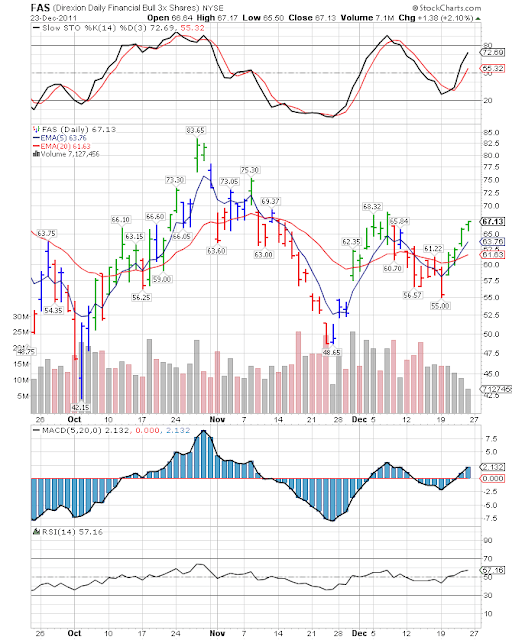

Momentum ETFs (23 Dec 11): FAS

Sunday, December 18, 2011

Leveraged ETFs (19 Dec 11): EDZ

Traditional ETFs (19 Dec 11): TLT

Fixed Income ETFs (19 Dec 11): TMF

Bull Call Spread (19 Dec 11): TLT

|

| Look for a bullish market where you anticipate a modest increase in the price of the stock above the price of the short Call option. |

TLT $46.26

Buy to Open (1) Jan 12 118 C @ $5.20Sell to Open (1) Jan 12 123 C @ $2.27

Net Debit: $2.93 ($293.00)

Breakeven: $120.93

Max. Profit: $207.00

Pct Return: 70.7% (33 days)

Bear Put Spread (19 Dec 11): SSO

|

| Look for a bearish market where you anticipate a modest decrease in the price of the stock below the strike price of the short Put option. |

SSO $43.55

Buy to Open (1) Jan 12 48 P @ $5.25Sell to Open (1) Jan 12 43 P @ $2.18

Net Debit: $3.07 ($307.00)

Breakeven: $44.93

Max. Profit: $193.00

Pct Return: 62.9% (33 days)

Sunday, December 11, 2011

Leveraged ETFs (12 Dec 11): TNA

Traditional ETFs (12 Dec 11): XRT

Fixed Income ETFs (12 Dec 11): TMV

Bull Call Spread (12 Dec 11): SSO

|

| Look for a bullish market where you anticipate a modest increase in the price of the stock above the price of the short Call option. |

SSO $46.26

Buy to Open (1) Jan 12 43 C @ $5.05Sell to Open (1) Jan 12 48 C @ $2.00

Net Debit: $3.05 ($305.00)

Breakeven: $46.05

Max. Profit: $195.00

Pct Return: 63.9% (40 days)

Bear Put Spread (12 Dec 11): TLT

|

| Look for a bearish market where you anticipate a modest decrease in the price of the stock below the strike price of the short Put option. |

TLT $116.71

Buy to Open (1) Jan 12 120 P @ $5.55Sell to Open (1) Jan 12 115 P @ $2.64

Net Debit: $2.91 ($291.00)

Breakeven: $117.09

Max. Profit: $209.00

Pct Return: 71.8% (40 days)

Sunday, December 4, 2011

Leveraged ETFs (5 Dec 11): ERX

Traditional ETFs (5 Dec 11): XOP

Fixed Income ETFs (5 Dec 11): HYG

Bull Call Spread (5 Dec 11): SSO

|

Look for a bullish market where you anticipate a modest increase in the price of the stock above the price of the short Call option. |

SSO $45.49

Buy to Open (1) Jan 12 42 C @ $5.45

Sell to Open (1) Jan 12 47 C @ $2.33

Net Debit: $3.12 ($312.00)

Breakeven: $45.12

Max. Profit: $188.00

Pct Return: 60.3% (48 days)

Bear Put Spread (5 Dec 11): VXX

|

Look for a bearish market where you anticipate a modest decrease in the price of the stock below the strike price of the short Put option. |

VXX $40.79

Buy to Open (1) Jan 12 40 P @ $4.40

Sell to Open (1) Jan 12 35 P @ $1.58

Net Debit: $2.82 ($282.00)

Breakeven: $37.18

Max. Profit: $218.00

Pct Return: 77.3% (48 days)

Subscribe to:

Posts (Atom)